An Employer’s Perspective: Should You Hire a Contractor or Full Time Employee?

As the business landscape continues to evolve and the struggle to find top talent persists, it’s worth re-evaluating your hiring practices in order to optimize your workforce.

For instance, it’s becoming more common for many top IT professionals to choose contract and consulting opportunities over full time, permanent positions. But this trend brings with it a hoard of complexities and questions regarding the many pros and cons behind choosing to hire a contractor or full time employee.

At KORE1, we see many different hiring scenarios on a daily basis. We hope this summary below helps answer some questions.

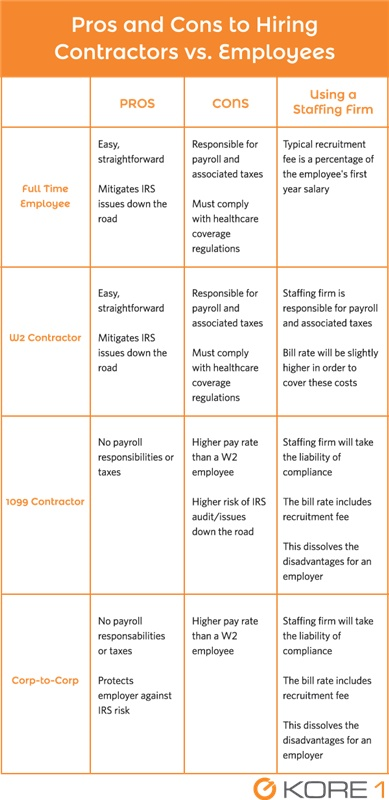

Hiring a Full Time Employee

Pros This is the option you’re probably most familiar with. It’s the easy route, whether you’re hiring hourly or salaried employees, and there’s little risk of any IRS issues down the road. And even though contract and consultancy trends are becoming more popular, this is still the most comfortable option for many professionals in the workplace.

Cons Most businesses are so used to hiring full time employees that they probably don’t even blink an eye at the disadvantages. These include the responsibilities of withholding income taxes, withholding and paying your portion of Social Security and Medicare, and paying unemployment taxes. Additionally, you’re responsible for filing payroll reports and complying with healthcare coverage regulations. These obligations require expert accounting and HR resources, creating greater overhead expenses for your organization.

For assistance in hiring all types of employees, contact us today.

Hiring a W2 Contractor

Pros This option operates almost identically to hiring a full time employee, except that the hiring agreement is on a temporary, contract basis. Once again, it’s a straightforward option, especially if you’re working with a recruiter, in which case, the contractor will be employed by the staffing firm.

Cons The disadvantages to hiring a W2 contractor are identical to hiring a full time employee. However, if you do choose to work with a staffing firm, these responsibilities will fall on them, as the employer. The staffing firm will take care of payroll processing and withholding and paying various taxes. In this scenario, you will notice a higher markup on the contractor, in order to cover those expenses.

Hiring a 1099 Contractor

Pros A 1099 contractor is the sole proprietor of an unincorporated business – in other words, the business has no existence apart from the individual. If you decide to hire a 1099 contractor, you won’t have to withhold and/or pay any income taxes, Social Security, Medicare, and unemployment taxes. You also don’t have to worry about providing any benefits. That basically takes the burden and expense of payroll and HR entirely off your hands.

Cons With reduced responsibility, however, comes greater reliance on the individual you’re bringing aboard. It will be the contractor’s obligation to comply with federal and state tax laws, but if he or she fails to do so, your business will be at higher risk for being audited by the IRS. If they question the legal validity of the classification of contractor vs. employee, you may be penalized with back taxes.

However, if you choose to work with a staffing firm, the liability falls on them. Either way, a 1099 contractor will likely be a pricier option, since they need to be able to cover their own taxes and benefits.

Hiring a Corp-to-Corp Contractor

Pros A corp-to-corp contractor is an individual who has incorporated their business as a separate entity from themselves. Rather than an employment agreement then, there is instead a contract between your business and the contractor’s business, of which the individual is an employee. Under this hiring alternative, your organization won’t be responsible for paying and withholding taxes or filing payroll. Additionally, you will be protected against IRS risk and any issues related to the employer-employee relationship.

Cons If you choose to go corp-to-corp, you’ll be looking at a significantly higher bill rate. And this makes sense: you won’t have to worry about any taxes, payroll or HR functions, plus you’ll have peace of mind in being protected from any IRS-related issues.  If you’re trying to decide whether to hire a contractor or full time employee, let KORE1 take the burden off your hands. No matter which scenario makes sense for your business, we have the resources and networks to fulfill your staffing needs. Just contact us today.

If you’re trying to decide whether to hire a contractor or full time employee, let KORE1 take the burden off your hands. No matter which scenario makes sense for your business, we have the resources and networks to fulfill your staffing needs. Just contact us today.